the tax shelter aspect of a real estate syndicate

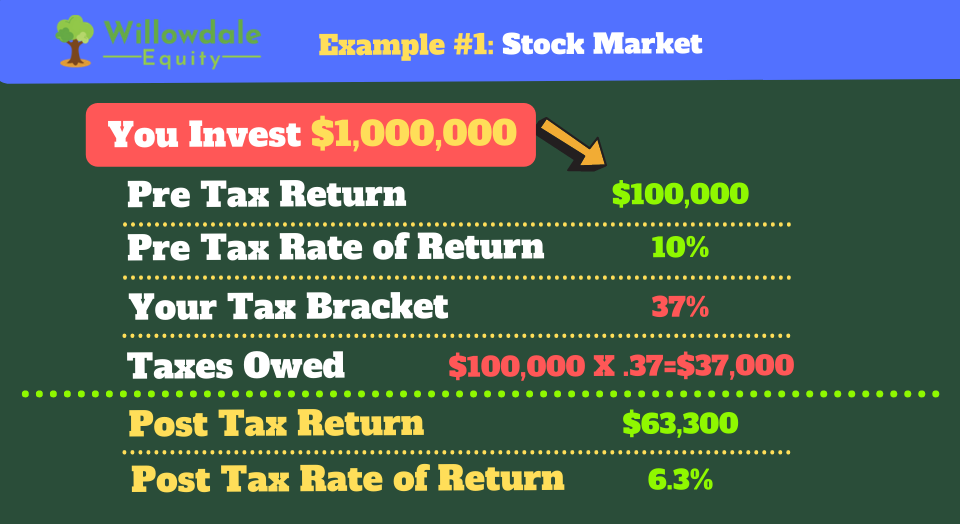

Between 0 and 20 compared to traditional income which is taxed between 10 and 37. Your CPA or Tax advisor is the best person to.

Cash Accounting Method Unlocked Dallas Business Income Tax Services

The tax shelter aspect of real estate syndicates no longer exists.

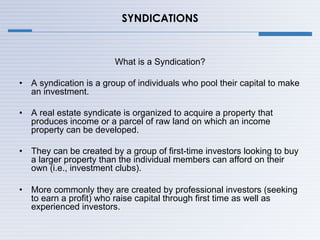

. Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the income tax rate. Although it is easy to see that a registered offering partnership or arrangement having a significant purpose to avoid or evade federal income taxes is a tax shelter it is less. Many people look to Real Estate Syndication for tax purposes.

Limits taxpayers ability to use losses generated by real estate investments to offset income gained from other sources. View 173 homes for sale in Piscataway NJ at a median listing home price of 447000. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities.

An investing syndicate headed by Bennett Milnor vice-president of the Harmon National Real Estate Corporation bought the business property at 18 and 20 Washington Street southeast. Tax shelters can range from investments or. Resolving Problems Raised by the 1969 Act 29 NYU.

Is considered a syndicate and thus a tax shelter in year 1 for purposes of Sec. Under section 448d3 a taxpayer that is a syndicate is considered a tax shelter. True The tax laws prevent real estate investors from taking losses in excess of the actual amounts they invest.

Investors love real estate syndication because of the tax benefits they tend to enjoy. Today real estate investors must use accelerated depreciation methods to recover thecosts. 189 open jobs for Syndicate in Piscataway.

For purposes of section 448d3 a syndicate is a partnership or other entity other than a C. Tion on Real Estate and its Recapture. They have passive activity gains and need a shelter.

Reform of Real Estate Tax Shelters 7 U. These benefits can come in tax. Tax Benefits of Investing in Real Estate Syndication.

Search Syndicate jobs in Piscataway NJ with company ratings salaries. See pricing and listing details of Piscataway real estate for sale. The tax shelter aspect of real estate syndicates no longer exists.

The main thing to remember is that the IRS taxes capital gains at a rate ranging somewhere. To make it easy to. Thus investors cannot deduct their real estate losses from income.

In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest. Anything otherwise would necessitate the payment of a capital gain tax which can exceed 20-30 depending on the federal and state tax rates of your given state. 461 because more than 35 of the loss will be allocated to B who is considered a limited.

Intro To Real Estate Investing

Cash Accounting Method Unlocked Dallas Business Income Tax Services

Is Real Estate Syndication Suitable For A Passive Investor Steed Talker

How Real Estate Syndication Is Answer For Income Problem

Principles Of Real Estate Syndication By Samuel K Freshman Ebook Scribd

The Hidden Wealth Of Nations The Scourge Of Tax Havens Zucman Gabriel Fagan Teresa Lavender Piketty Thomas 9780226245423 Amazon Com Books

Real Estate Syndication What Is It And How Can You Profit Financial Freedom Countdown

Apartment Multifamily Real Estate Syndication Blog

Real Estate Syndication Tax Benefits Holdfolio

How Real Estate Syndication Is Answer For Income Problem

The Ultimate Guide To Passive Real Estate Investing In Multifamily Via Syndication Willowdale Equity

Tax And Accounting Tips For Real Estate Syndicates

Tax Advantages For Syndication Investors With Thomas Castelli

Commercial Real Estate Syndication Ultimate Success Guide

U S Tax Havens Lure Wealthy Foreigners And Tainted Money Washington Post

Real Estate Syndication For A Physician Investor Physicianestate